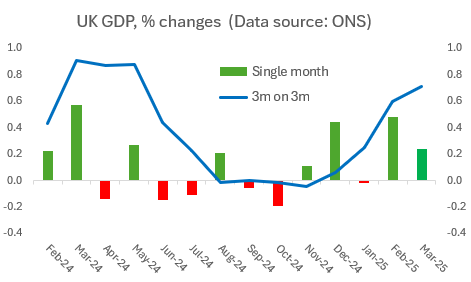

The first official estimates suggest that the UK economy grew by 0.7% in the first quarter of the year, which was better than most had expected. GDP per head increased by a respectable 0.5%.

On the bright side, this should trigger a wave of upward revisions to growth forecasts for 2025 as a whole. (I have already nudged mine up from 1% to 1¼%.) The fading fears of a global trade war mean that the risks around these forecasts are now more evenly balanced too.

Of course, a few tenths of a percent either way is not a big deal in itself. But even just 1¼% would be better than the 1% expected by the Bank of England and the OBR, or the average of new independent forecasts in the Treasury’s April survey, which was only 0.8%..

The positive headlines could also help to improve consumer and business sentiment. Several polls suggest that households and firms are still fairly confident about their own prospects, but are delaying spending because of worries about the economy as a whole. Today’s better news might therefore ease these concerns and close this gap.

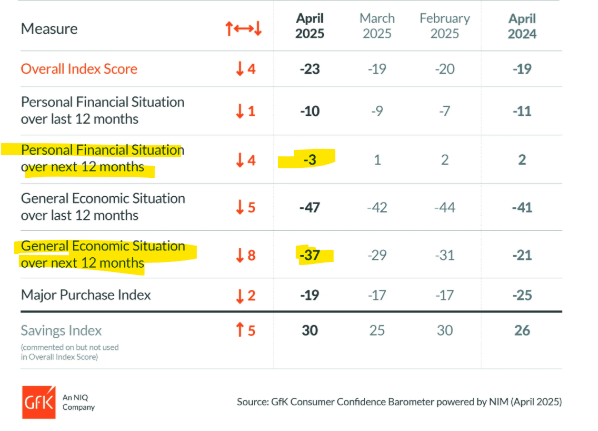

Here, for example, is the latest GfK poll of consumer confidence…

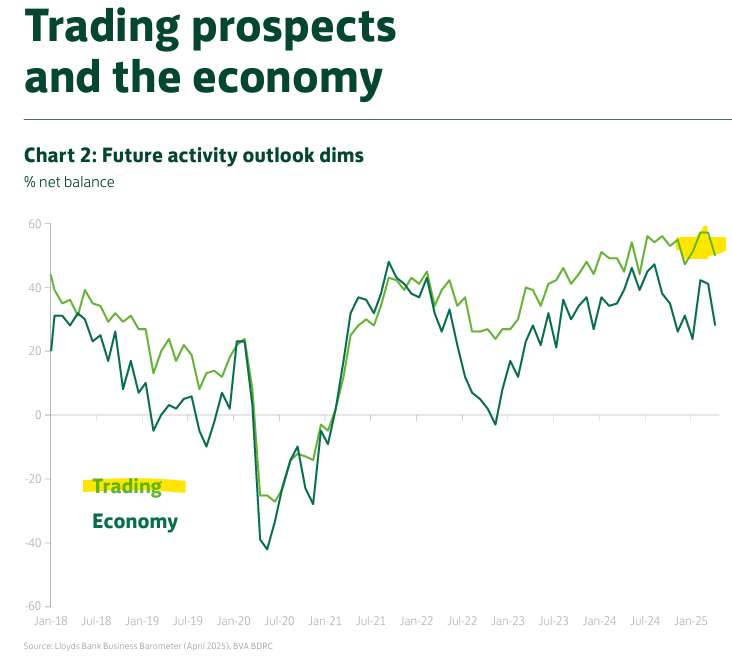

…and here is the Lloyds Business Barometer (firms remain upbeat about their own trading prospects despite concerns about the wider economy)…

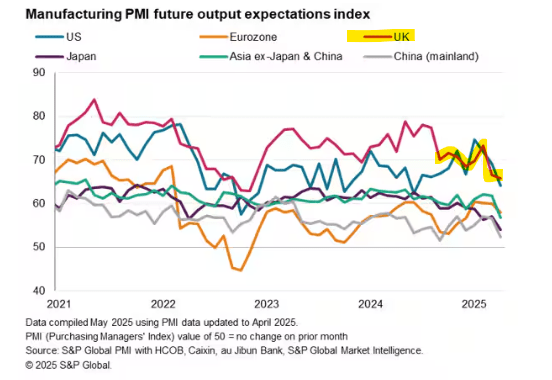

Even UK manufacturers are still less pessimistic than their peers in the euro area about the prospects for their own output over the next 12 months.

Unfortunately, there is no shortage of caveats.

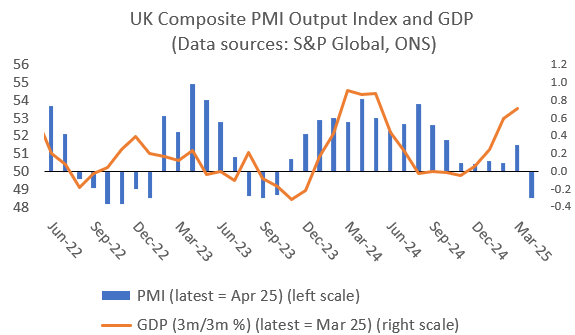

For a start, the first quarter’s strong growth needs to be seen in the context of the weakness in the second half of 2024. 0.7% was also still slower than the 0.9% reported in the same quarter of last year, which may be significant given doubts over the reliability of the seasonal adjustments.

Moreover, Q1’s growth was flattered by a 5.9% jump in business investment, which appears to be at least partly due to spending brought forward ahead of Trump’s tariffs. Exports were also relatively strong, perhaps for the same reasons. Consumer spending rose by just 0.2%, despite the gains in real incomes.

Most importantly, these figures cover a period before the big jumps in employment costs in April. Surveys of private businesses suggest that these cost increases hit activity hard, especially as many firms are also continuing to struggle with high energy costs and the prospect of even more red tape (including the so-called ‘Employment Rights Bill’).

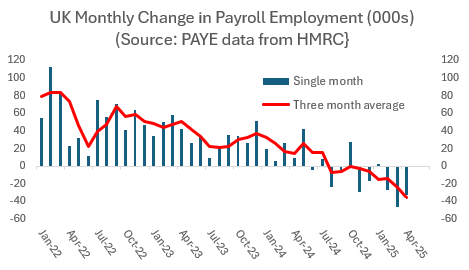

The news on jobs in particular is still likely to get a lot worse before it gets better. The official figures here are all over the place, but the latest PAYE data show another hefty drop of 33,000 in payroll jobs in April, with a total fall of 152,000 since July 2024.

My best guess (based on surveys such as the CIPD Labour Market Outlook) is that the UK will shed another 200,000 payroll jobs (+/- 100,000) before a recovery begins later this year.

Payroll employment would still be around 30 million, and the cooling in the labour market will at least make it a little easier for the Bank of England to keep cutting interest rates. But any large-scale job losses are obviously worrying, and the negative headlines here will weigh on spending for a while yet.

Either way, the Labour government deserves little credit for the strength of the first quarter numbers, and could still mess things up again. Clumsy interventions in energy, labour and asset markets remain big downside risks, while the net impact of the ‘EU reset’ could go either way.

In short, the UK economy may have made a flying start to the year, but this will be as good as it gets.