The Bank of England’s decision to hold interest rates at 3.75% today was no great surprise, but the 5-4 vote was much closer than most had anticipated. Unfortunately, this dovish tilt owes more to rising concerns about growth and jobs than it does to increasing optimism about inflation, even though the two are of course related.

In particular, Bank staff nudged down their GDP forecast for 2026 from 1.2% to just 0.9%, which would be slower than the 1.4% estimated for 2025. More worryingly, it would be half a percent below the OBR’s forecast of 1.4% for 2026 which was baked into last November’s Budget.

This is becoming a trend. The average of new forecasts for 2026 in the Treasury survey has fallen from 1.2% last November to 1.1% in December and most recently to 1.0% in January.

The detail of the Bank’s GDP forecast (below) is interesting too. 2025’s surge in real post-tax labour income is forecast to peter out, with consumer spending propped up instead by a fall in the household saving ratio. Rather a lot also depends on the continued growth of government expenditure and, looking further ahead, on a boom in housebuilding.

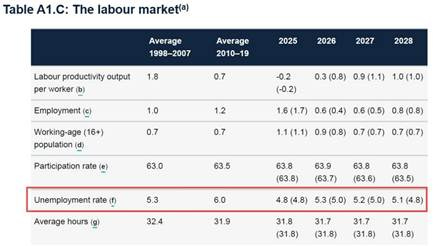

Bank staff also raised their forecasts for the unemployment rate for every year from 2026 to 2028 (as shown below). The economy is still expected to add jobs, but not enough to keep pace with the increasing number of people looking for work.

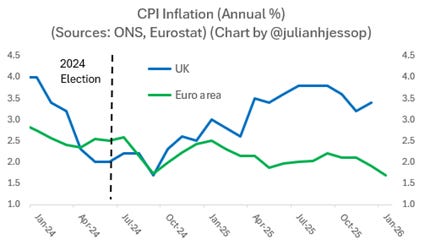

This might have been enough to tip the balance towards a rate cut today. However, the Bank of England has been unable to ease policy as quickly as many other central banks because of the UK’s relatively high rate of inflation. This mainly results from government policies, notably on tax, energy prices, and the labour market.

Business surveys suggest that underlying cost and price pressures remain strong and may even be strengthening, while inflation expectations are still too high for comfort. Growth in broad money and credit is also accelerating.

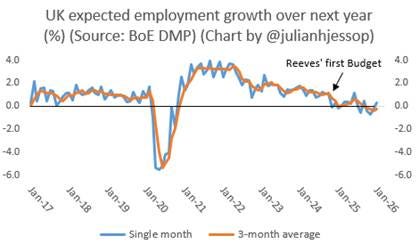

On the other hand, the labour market remains weak. The Bank’s latest Decision Maker Panel survey suggests that expectations for employment growth over the next year may finally be levelling out, but they are still subdued.

Here, the latest survey of Bank Agents adds to the evidence showing that the weakness of employment mainly reflects a lack of hiring rather than a surge in firing, with “higher labour costs and the possible impact of the Employment Rights Bill” accelerating the adoption of AI. This should at least be good for productivity, but it will not ease concerns about job security.

There are a few signs of ‘green shoots’ in some surveys as Budget uncertainty eases, even in the construction sector. But these could be stamped out if the Bank is unable to deliver the further rate cuts that most expect.

On balance, it does look increasingly likely that the Bank will cut rates by another quarter point in the spring, with March now the marginal favourite over April. This could be followed by another quarter by the autumn, taking rates to 3.25%. However, this is now more or less fully priced into the markets, meaning the risk of disappointment is high.

You can follow me on X (formerly Twitter) @julianhjessop and on BlueSky.

I also now post regularly on Substack