The early omens for 2026 are not good. The UK is stumbling into the New Year on the brink of recession. Indeed, the economy stopped growing last summer as Budget jitters began to undermine confidence and spending again.

Only some favourable rounding in August prevented headline GDP from falling in every month from July to October 2025. We are still awaiting the official data for November and December, but the latest business surveys suggest that the economy ended last year with a whimper.

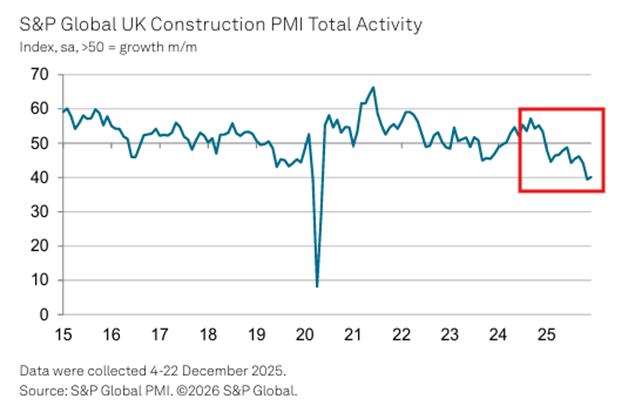

The weakness of the construction sector is symbolic of many policy failures. Despite the Labour government’s appeals to “build, baby, build!”, the S&P Global UK Construction PMI suggests activity is collapsing. The December index was only just above the post-Covid low hit in November.

Overall, the UK economy probably grew by around 1.3% in 2025. This would only be a little better than the 1.1% in 2024. More ominously, it would already be a little worse than the 1.5% assumed by the OBR for the November Budget.

There are still some decent reasons to think that the economy could improve in 2026.

One is that, despite everything, the finances of both the household and corporate sectors are in good shape. Many individual families and smaller businesses will continue to struggle. Nonetheless, the household sector as a whole has been saving a larger than usual proportion of its income for several years.

More of these excess savings could now be used to support higher spending if – obviously a big if – consumers feel confident enough to save less or borrow more.

Similarly, corporate debt ratios are still comfortable, and credit spreads are tight. This means that most firms could borrow more relatively cheaply if – that word again – they have the confidence to invest and hire.

This is not an entirely forlorn hope. Encouragingly, business investment was already one of the few bright spots of 2025. The UK has also continued to score highly in surveys of attractiveness for inward investment, notably the study by EY.

Any improvement in the economy still needs a catalyst. But there are several potential candidates, including the end of the worst of the pre-Budget uncertainty, further falls in inflation, and further cuts in official interest rates. At 3.75%, the Bank rate is still towards the top end of a “neutral” range, which is between 3% and 4%.

Alas, this is where any remaining seasonal good cheer runs out. Further falls in inflation and in interest rates are now increasingly “priced in”, so there is a growing risk of disappointment if they fail to materialise.

And there are at least three new downside risks for 2026.

The first is persistent weakness of the labour market. A few polls suggest that the pace of job losses is slowing and that some firms may be ready to start recruiting again in the spring. Unemployment is also still low by past standards.

However, government policies which have raised the cost of labour and made hiring and firing more difficult have done lasting damage to employer confidence.

There was certainly little sign that the UK is “turning the corner” in the latest IoD Directors’ Economic Confidence Index. The headline measure of business leaders’ optimism was still just -66 in December, up only a little from the (pre-Budget) November level of -73. Headcount expectations fell to -14 from -8, and investment intentions fell to -21 from -17.

Consumer confidence is also subdued. In particular, household fears about job security are increasing, which is likely to keep precautionary saving high.

The second (and not unrelated) risk is a resurgence of policy uncertainty, including fears of yet another round of tax increases in the next Autumn Budget. Keir Starmer’s premiership is in crisis, and the prospect of a leadership challenge will keep businesses and investors on edge. While it might be difficult to imagine someone doing a worse job, the markets still fear an even more left-wing alternative.

If Rachel Reeves is still in post after the summer, the Treasury could simply dust off some more of the “smorgasbord” of increases in taxes on the slightly better off that were floated in the run up to the last Budget. However, a more left-wing Chancellor could increase spending even further, requiring bigger tax increases – including new taxes on wealth.

A desperate Labour government also looks set to waste time trying to “move closer” to the floundering EU, rather than make more of the opportunities created by leaving. Ironically, Brexit had dropped way down the list of concerns for the public and, at least as importantly, for businesses. Reviving Brexit uncertainty could do more harm than good, especially as the EU seems as determined as ever to punish the UK for daring to break away.

The third risk is a financial market crash, whether prompted by domestic economic and political factors or by external shocks. This may well be the year when the Trump balloon finally pops. The key risks to the US economy all lie on the downside – including rising unemployment, the delayed fallout from tariff wars, a fight with the Fed, and the bursting of the AI bubble.

Unfortunately, our own government appears to have given up on growth altogether in favour of policies designed to redistribute income and wealth, and to expand the role of the state.

For example, the Labour government’s plan to tackle the cost of living crisis is a scrappy list of measures which will do nothing to solve the underlying problems. The recent interventions on prices (such as energy levies and rail fares) should reduce headline inflation, but only temporarily and by just a few tenths of a percentage point.

Moreover, taxpayers will simply pick up the bills instead. This will leave many households no better off, while distorting incentives further.

Meanwhile, government interventions in many areas, notably energy, housing and labour markets, are adding to cost and price pressures. Low productivity in the public sector is dragging the whole economy down.

The upshot is that the UK economy will continue to struggle in 2026. Even if a formal “recession” is avoided, growth will be weaker this year than last – perhaps well below 1% in headline terms and barely positive at all after adjusting for population growth.

This will not be enough to end the “doom loop” of deteriorating public finances and ever higher taxes that has already been the hallmark of the Starmer government. Labour has crushed the “animal spirits” that drive growth. Unfortunately, it is very hard to regain economic confidence once it has been lost.

This is an extended version of a piece first published by The Critic on 7 January 2026

You can also find me on X (formerly Twitter) @julianhjessop and on Substack