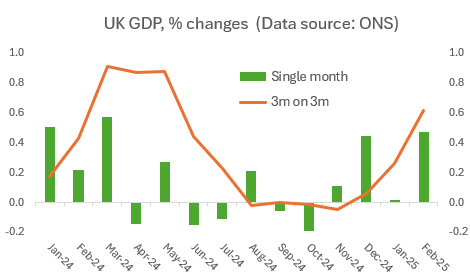

The news that the UK economy grew by 0.5% in February, lifting the three-month growth rate to 0.6%, is obviously welcome. But these ONS figures should come plastered with health warnings.

For a start, monthly GDP data are notoriously volatile, and often revised. A sharp correction is possible in March and especially in April, when the increases in taxes and other business costs in last October’s Budget actually kick in.

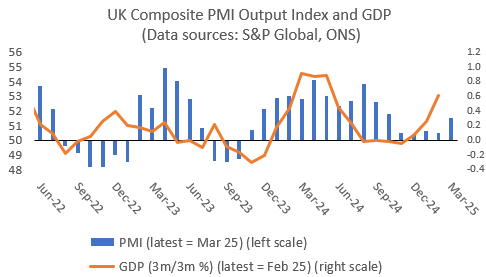

Moreover, the official data are far stronger than indicated by the latest business and consumer surveys. These do suggest that the economy has picked up a little, but nowhere near this strongly. My next chart illustrates this point using the composite PMI, which covers manufacturing and private sector services.

February’s data may also have been flattered by some special factors. In particular, there was a 2.2% jump in manufacturing output, which again is hard to square with the industry surveys.

This may have been boosted by activity brought forward to beat new US tariffs, or just reflect the usual noise in these data. Either way, a global trade war remains a big downside risk for the rest of the year.

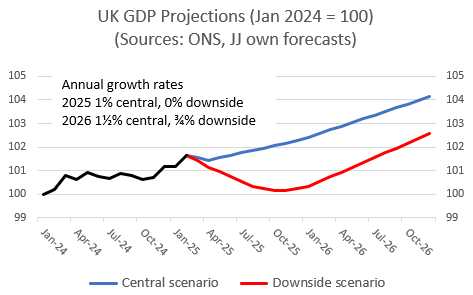

That said, there are some encouraging signs in the data too. Above all, consumer spending on services is rising strongly. With real wages still growing at a decent pace and household savings relatively high, the UK economy is still likely to grow by around 1% over the year as a whole.

However, sentiment is clearly fragile, especially with the labour market weakening, taxes expected to rise further, and the US-China trade war escalating.

This is reflected in my downside scenario below, which attempts to capture the effect of a full-blown global trade war.

Overall, the UK economy still looks set to avoid the outright recession that some feared, but the risks all seem to lie in the wrong direction.

Ps. many are asking (quite reasonably) how much we can trust the ONS on GDP. Here’s my take…

The problems at the ONS are well-known, but they mainly apply to the labour market surveys, reflecting falling response rates (an issue in many other countries too).

The ONS itself has also identified errors in processing data which have caused some other releases (notably on trade and producer prices) to be delayed. Finally, there are doubts over the reliability of the seasonal adjustments, especially given changing patterns of consumer spending.

But I am not aware of any particular problems with the monthly GDP data, other than the obvious point that monthly estimates are never going to be very reliable. Indeed, this is why so few other countries publish monthly GDP. Personally, I would give the under-fire and under-resourced ONS some credit for even trying!

UK statisticians also did a better job than most at capturing the impact of the pandemic, especially on the output of public services.

Nonetheless, I still would not give much weight to the monthly GDP figures, given their inherent volatility.