The latest official data are perhaps not as bad as some headlines suggest, but they do confirm that the UK economy made a poor start to 2025.

First, the raw numbers. Monthly GDP fell by 0.1% in January, against the consensus forecast of a 0.1% rise, led by a 0.9% fall in the production sector (mainly due to declines in manufacturing output and in oil and gas). Construction output was also weak, falling another 0.2%.

Services output edged up by 0.1%, but with some notable areas of weakness too especially in the embattled hospitality sector (‘accommodation and food services’ and ‘arts, entertainment and recreation’). This confirms that the unexpected strength of retail sales in January was flattered by the diversion of consumer spending from pubs and restaurants.

This is not (yet) a disaster. The 0.1% contraction in January was partly a correction after the unexpectedly large increase of 0.4% in December. The underlying trend rate of growth is probably still around 0.2% per quarter, as signalled by business surveys such as the PMIs.

Nonetheless, this feeble rate would remain well short of the numbers baked into last October’s Budget (when the OBR forecast full-year growth of 2% in 2025). And this is even before the main measures actually kick in next month.

The best hope is that the current weakness is only temporary as businesses anticipate and adjust to the higher costs, with much of April’s bad news therefore already in the data. The economic outlook is also unusually uncertain, both at home and abroad, which is holding back some hiring, investment, and spending.

Activity could then pick up again once April is out of the way and if the UK continues to use the Brexit freedoms to avoid the worst of the global trade wars. The loosening of fiscal policy in Germany could help British firms selling into the euro area too (remarkably, the UK was still the joint fastest growing G7 economy in Europe in the final quarter of 2024, though this was a very low bar!).

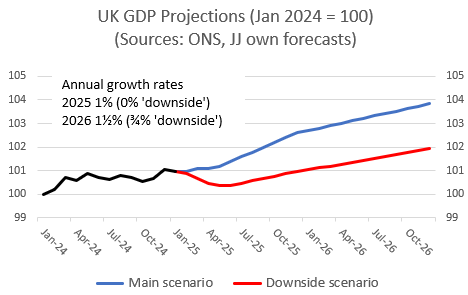

These potential positives are reflected in my main scenario, where UK growth comes in at about 1% this year.

But there is also an increasing risk that the announcement of a further round of tax rises and spending cuts in the fiscal event on 26 March will prolong the doom loop. The labour market is now also starting to crack under the weight of higher costs and increased regulation.

In my downside scenario, the economy would struggle to grow at all this year, and would contract in the first half.

In short, the economy is already on a knife edge, and the Chancellor could be about to tip the UK into a full-blown recession.

Julian – I wish I shared your optimism in the GDP projections graph whereby whatever happens the UK economy grows in H2 ’25. Whilst I agree that Germany (finally) loosening the fiscal strings may help Europe as a whole, (a) Labour have simply no idea – any more tax on productive enterprise could become reinforcing – all that is holding the economy up ATM is the growth in public sector wages, and the Net Zero agenda is a gigantic act of self-harm ; (b) the EU is a disaster – and the only positive would be if the Euro devalues; (c) Trump’s inconsistency adds to the issues. What do you think happens to GDP per capita – my guess is we get (a lot) poorer over the next few years. Hope all well David

LikeLiked by 1 person