I know 2021 will be another tough year for many people and businesses, but I’m aiming here to provide some counterbalance to the more negative commentary you can easily find elsewhere…

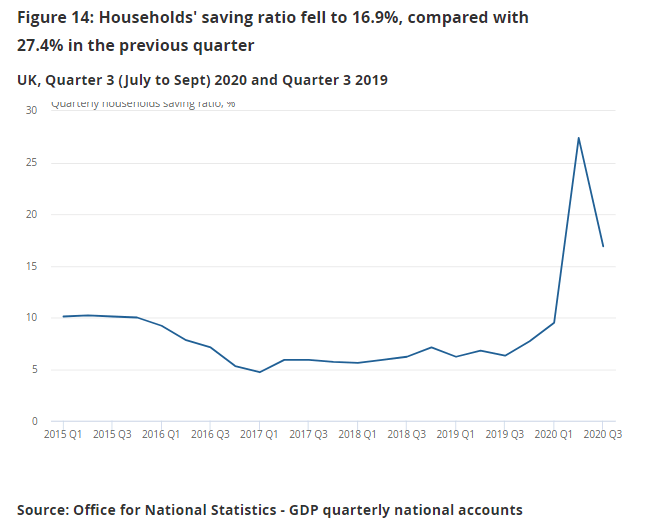

1. The household sector (in aggregate) has built up substantial savings during the pandemic that could be used to fuel a strong recovery in consumer spending. Obviously, the distribution is uneven and much still depends on confidence. But…

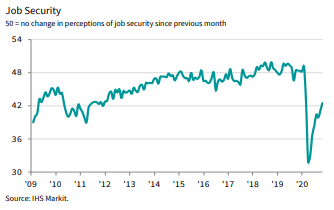

2. Consumer confidence jumped by the most in eight years in December on the good news on the vaccine. Even in November, households were the least pessimistic about job security since March, despite the grim headlines.

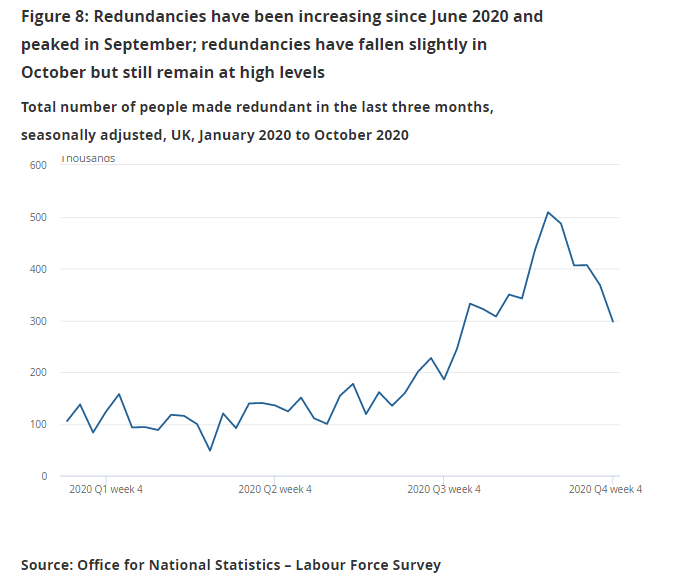

3. The unemployment rate has risen but remains relatively low (mainly thanks to furlough) and is roughly half where some feared it might be, reducing the risk of long-term scarring. The number of people made redundant in the past three months did at least peak in September…

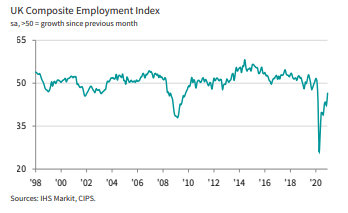

4. … while various measures of hiring have continued to recover, including online job ads and surveys of employment. Once the Covid restrictions are lifted, people will still want to go to pubs, restaurants, cinemas and theatres – perhaps more than ever.

5. One way or the other, Brexit uncertainty will ease very soon (probably with a deal). Businesses will finally know the new arrangements for UK-EU trade (whatever they may be) and policy-makers can refocus on other priorities.

6. The lifting of both Brexit and Covid uncertainty should also help to drive a surge in business investment. Many surveys show that the UK’s long-term attractiveness remains high, and that projects have typically been postponed rather than cancelled.

7. Consistent with this, London has cemented its dominance as Europe’s top financial centre, with far fewer City jobs relocating to the EU than had been predicted (and even some of these may come back). Indeed, Edinburgh ranks higher (for competitiveness) than Frankfurt or Paris.

8. Despite the jump in public debt, UK government borrowing costs remain very low (further weakening the case for any form of austerity, including tax hikes). Very loose monetary policy is helping to provide cheap finance for households and companies too.

9. Equity markets have held on to almost all their gains since 9th November, when it was first revealed that the Pfizer–BioNTech Covid vaccine could be 90% effective. (Even if you don’t hold equities yourself, this is good for the economy)…

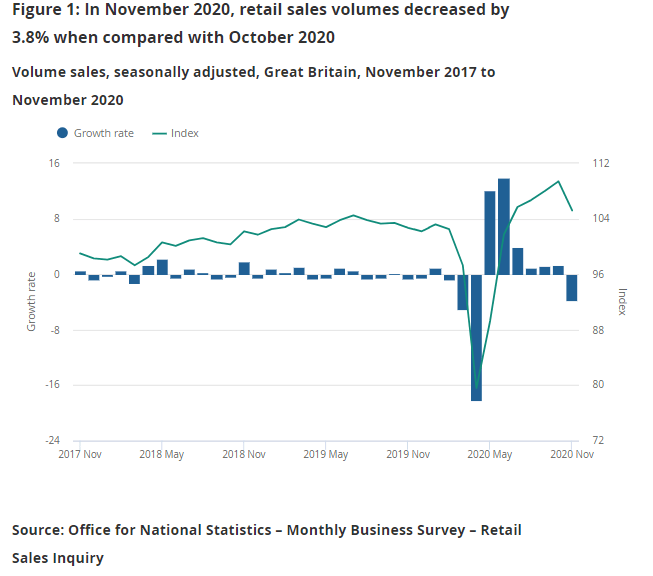

10. In the meantime, the economic hit from the second #lockdown in November was smaller than feared, and far smaller than the first. Markets, consumers, and businesses (at least those that can) have adapted well. (But hospitality in particular may need more support.)

11. The v-shaped recovery in retail sales is reassuring. This has been flattered a little by the diversion of spending from other sectors, and is vulnerable to further lockdowns. But the recovery in total sales also illustrates the adaptability of the economy, especially online.

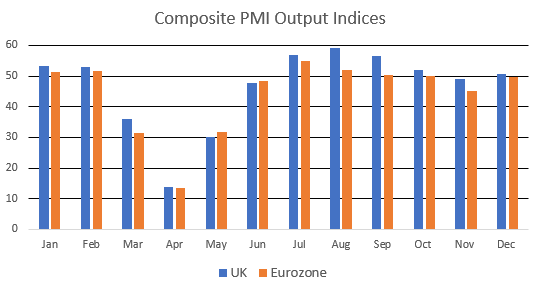

12. The global backdrop is improving too. The EU may lag behind the rest of the world, due in part to a slower rollout of the Covid vaccine and the straitjacket of the euro. But the US and China are recovering strongly.

I wish everyone a very happy Christmas and better times ahead. Stay safe and take care. JJ