Friday was a relatively good day for UK economic data, with the latest news on the public finances, retail sales, and the PMI survey all better than expected. This followed Wednesday’s confirmation that headline inflation fell back in January. But is this really evidence that the worst is over – and are the Labour government and their cheerleaders right to claim credit? Here is a closer look at each release in turn…

1. UK inflation is still relatively high despite January’s fall

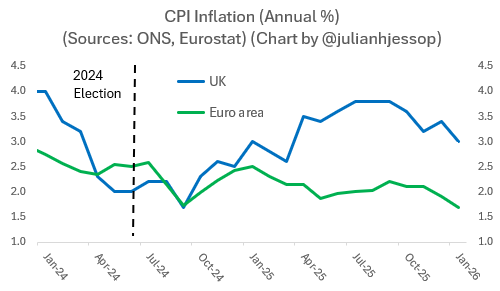

The renewed decline in CPI inflation in January, from 3.4% to 3.0%, was obviously welcome, but this rate is still a full percentage point higher than the official target of 2.0%. That target has not been met since June 2024, which happened to be the last month under the previous government.

The UK also remains an outlier. In particular, inflation in the euro area has been stable at around 2.0% and is expected to fall to just 1.7% in January.

What’s more, the fall in UK inflation in January owed little to anything that the Labour government has done – or at least anything positive.

The key drivers were favourable movements in the prices of motor fuel and food (reflecting declines in global commodity prices) and airfares (reflecting timing effects in the data). Inflation in the education sector also slowed, as the extension of VAT to school fees in 2024 dropped out of the annual comparison.

But otherwise, there was little change, with the core rate (excluding food & energy) slowing only marginally from 3.2% to 3.1%.

Looking ahead, inflation should drop more sharply in April, perhaps all the way to 2%. This would reflect the expected drop in domestic energy bills and smaller rises in other regulated prices, notably water bills and vehicle duties. In the meantime, the freeze on rail fares should lower inflation in March.

It would, of course, be much more reasonable to attribute this fall to Labour policy choices. Nonetheless, tinkering with regulated prices is not a proper strategy to deal with the cost of living crisis. The government is simply transferring costs from household bills to general taxation, leaving many families no better off, while preventing markets from working as well as they should.

There is also danger that inflation does not fall as far as expected, or that it does not remain lower for long. Business surveys suggest that underlying cost pressures remain sticky, and medium-term inflation expectations are still too high for comfort. This is partly a result of policy choices which have made labour and energy more expensive and increased the burdens of tax and regulation.

And for those of a monetarist persuasion, growth in broad money is running at annual rates of around 5%, which is also at the upper end of the comfortable range. This could mean that inflation just pops up somewhere else in the economy where prices are not being artificially capped.

Finally, even if inflation does drop back to 2% in April, this would simply return it to where it was when Labour took power. Not much to cheer here.

2. The jump in retail sales could soon be reversed

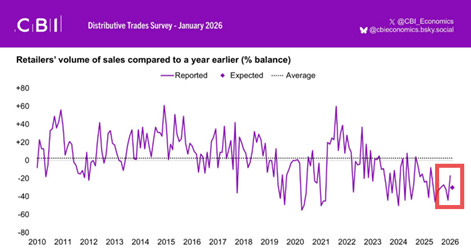

According to the initial estimate from the ONS, retail sales volumes increased by 1.8% month on month in January. This increase does appear to be genuine, echoing the more positive signals from the independent surveys run by the BRC and by the CBI.

However, the size of the jump probably says a lot more about the volatility of the monthly data, and especially the difficulty of adjusting for the variable timing of seasonal sales, than it does about the underlying trend. Retail sales had been weak over the previous two months, rising just 0.4% in December following a fall of 0.4% in November.

As a result, the quantity of goods bought still only rose by 0.1% in the three months to January 2026, compared with the three months to October 2025.

Moreover, it would not be a surprise to see a sharp correction in February, even if just because of the persistently wet weather! The CBI survey is already pointing downwards again.

3. January budget surplus boosted by one-off factors

The latest ONS data showed that the public sector recorded a £30.4 billion surplus in January, £15.9 billion higher than in January 2025, and £6.3 billion above the Office for Budget Responsibility’s November 2025 forecast.

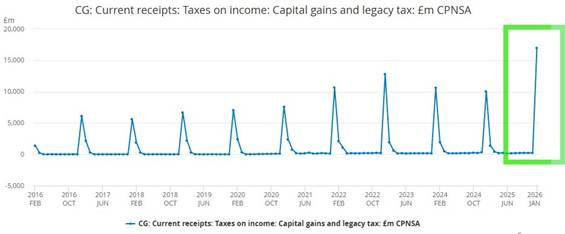

Here I would ignore the shouty headlines about this being a “record” surplus – January is always a bumper month for receipts, and the figures are not adjusted for inflation. But income tax and Capital Gains Tax (CGT) receipts were both a little higher than expected, and spending was slightly under the OBR’s forecast.

Now the caveats. Crucially, the surplus was boosted in January by the fact that people are having to pay a lot more tax. This is largely due to fiscal drag and higher tax rates rather than stronger economic activity. And in the case of CGT, some have chosen to pay more now because they fear taxes will be even higher in future. They have therefore sold assets earlier than they might otherwise have done (and, in some cases, left the country). Again, this is not much to cheer.

The chart below shows the importance of the spike in CGT receipts. These were up by nearly £7 billion in January compared to the same month a year earlier, but this is unlikely to be repeated. Put another way, you can only sell an asset once!

The bigger picture is that government borrowing is falling because tax revenues are rising faster than spending, at least for now, not because spending is being controlled. Indeed, spending and borrowing are still very high.

Here are some key facts.

Central government’s current receipts were £922 billion in the financial year to date (April 2025 to January 2026), £71.4 billion (8.4%) more than in the same period a year earlier.

However, central government spent £1,033 billion (including transfers to local government), up £47.9 billion (4.9%) on the same period a year earlier.

Of this, current expenditure (spending to fund day-to-day activities) was £915.7 billion, up £58.4 billion (6.8%). The biggest increases were in public sector pay and running costs, and in benefit payments.

These huge numbers should help to put the small improvement in the January data in perspective. Over the financial year to date, total borrowing was £8.3 billion less than forecast, with the current budget deficit (just) £3.4 billion lower than expected. All these differences are little more than rounding errors in the context of the public finances and could easily be revised away.

4. The PMI survey was the highlight

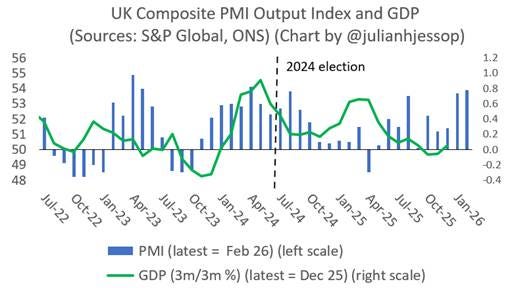

Arguably the best news on Friday was that S&P Global’s UK PMI Composite Output Index (covering manufacturing and services) improved again to 53.9 in February, which was a 22-month high. This is at least consistent with hopes of a stronger first quarter as Budget uncertainty eases.

Nonetheless, the detail shows that employment remains weak and price pressures are still strong. This casts doubt on the sustainability of the rebound, especially if inflation does not fall as quickly as many now hope, or if worries about government spending and taxation resurface.

A raft of other surveys show that businesses are still concerned about the fallout from government policies, notably the “Employment Rights Act”. For example, 84% of retail CFOs in the latest BRC survey ranked labour and employment costs in their top three worries, up from just 21% last July.

In summary, there has been some further encouraging news on growth, inflation and the public finances, but with some important caveats. What’s more, none of this can be attributed to government policies – at least not in a good way.