The latest GDP data should ease fears that the UK economy is sliding back into recession. But growth is still too weak to fix the public finances, or encourage hiring and investment, and there are already signs that any positive momentum is fading again.

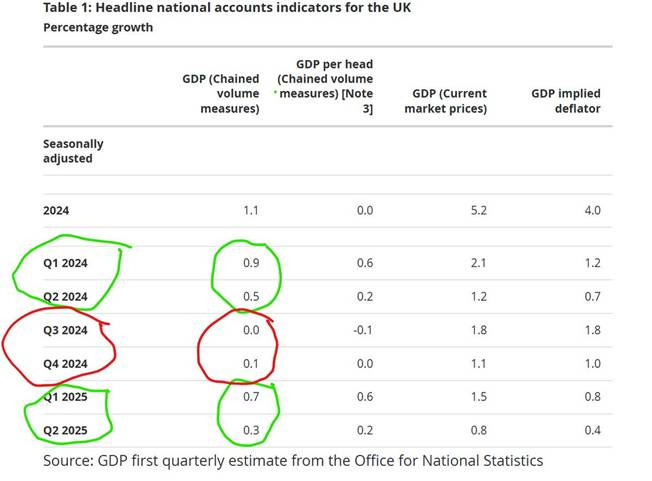

First, though, the good news. GDP grew by 0.3% in the second quarter, much better than the 0.1% (or less) that had been expected. GDP per head rose too, by 0.2%.

This was helped by a big upward revision to the monthly data for April (now down 0.1%, not 0.3%) and a 0.4% jump in June. Encouragingly, the economy appears to have recovered, at least partially, from the shock of the increases in tax and other costs in April.

Headline growth still slowed markedly from the 0.7% in the first quarter (when GDP per head rose by 0.6%). But this can largely be explained by the reversal of the earlier boost when companies brought activity forward to beat Trump’s tariffs. Changes in UK stamp duty played a part too.

The tariffs distortions also help to explain why growth in the euro area slowed even more sharply, from 0.6% to just 0.1%. GDP actually fell in Germany and in Italy (both by 0.1%) and in Ireland (by 1.0%).

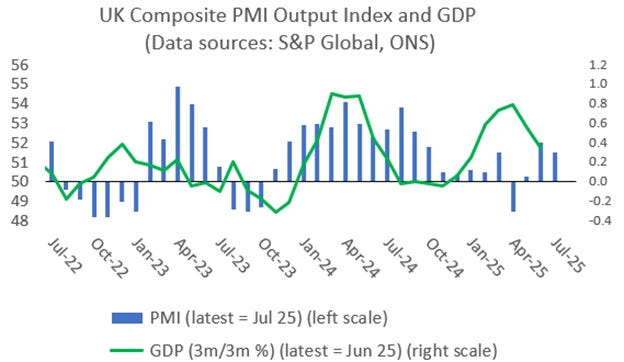

The latest UK GDP data bring quarterly growth closer to the underlying trend of 0.2-0.3% suggested by the business surveys, notably the PMI shown below, or about 1% annually.

But this where the goods news starts to wear thin. Growth might now be nearer 1.5% this year than 1% this year, but this would still be little better than last year (when the economy grew by 1.1%.)

Indeed, growth in each of the first two quarters of 2025 was still slower than in the same two quarters of 2024. The strong first half of this year was also partly just a temporary rebound from the poor growth in the second half of last year.

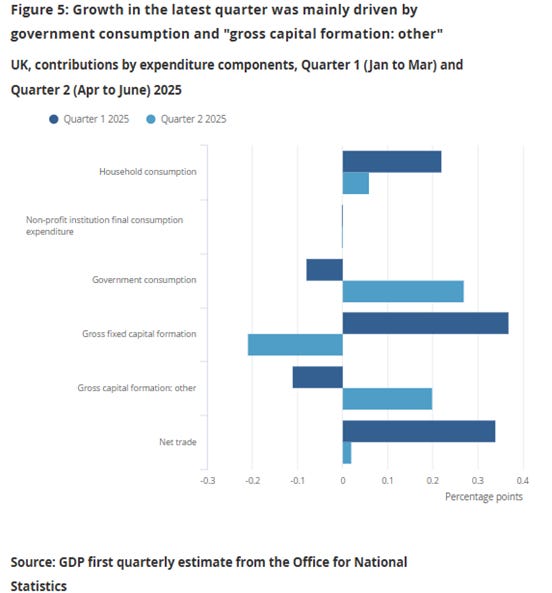

The expenditure breakdown of the second quarter data was not great, either.

Growth was led by government consumption spending (not investment), which the ONS mainly attributed to “higher expenditure on health (in particular on vaccinations) and public administration and defence”, and “gross capital formation: other” (which included an increase in stocks of unsold goods, which could be a drag on future output). In contrast, consumer spending and business investment were both much weaker.

Moreover, there are already signs that consumer and business confidence are stuttering again as inflation picks up further, and as another punishing Budget looms in the Autumn.

These sigs include the latest evidence from the construction sector. The GDP figures were helped by a 1.2% jumped in construction output. But the more timely surveys suggest that this will not last: the construction PMI was weak in July, and the latest RICS survey of the residential housing market was downbeat too.

In short, the GDP data were expected to be worse, so this is a rare piece of good news for Rachel Reeves. But there is nothing in the detail to suggest that the foundations of the UK economy are getting any stronger.