The recent slide in the pound against both the dollar and euro has prompted talk of ‘meltdown’ and ‘free fall’. Some commentators have already called this a ‘sterling crisis’, and speculated about what Tory politicians would be saying if it were happening under a Labour government. Even the normally sensible Conservative MP, Sam Gyimah, has described the ‘plummeting pound’ as ‘catastrophic’. Frankly, this is a load of baloney.

For a start, let’s try to keep a sense of perspective. The media usually focuses on the bilateral rates against the US dollar or the euro, because these rates are more familiar and easier to find in real time. But if you can, it is better to look at trade-weighted indices of the value of the pound against a basket of currencies. My first chart is one such index, compiled by the BIS and available via the Fred database.

A couple of takeaways. First, the pound has been in long-term decline for decades. Indeed, there would have been many times during this period when you could have written the headline ‘pound falls to record low’. Second, this year’s decline – marked in red – is trivial compared to previous episodes of sterling weakness.

The slump in 2016 was more significant. My second chart therefore zooms in on the last few years, this time using the Bank of England exchange rate index (which is handily updated daily). After the UK voted to leave the EU, the pound fell as much as 20% compared to a year earlier. However, even this did only a little more than reverse the rise from mid-2013 to 2015.

What’s more, the pound had begun to weaken well before the vote to leave. Uncertainty about the result may already have been weighing on sterling before the referendum actually took place, and it would be daft to claim that the result had no impact. But it is not necessarily right to attribute all the post-2015 weakness in the pound to Brexit either (a flaw in most studies that attempt to quantify the hit to GDP or real incomes).

UK GDP growth was relatively strong from 2013 to 2016 (the under-performance since 2016 is partly payback for that earlier strength). However, this was flattered by an unsustainable consumer boom and a record current account deficit, which the fall in sterling has helped to correct.

Above all, it is crucial to distinguish between levels and rates of change. While headline writers might love a ‘new low’, the level of the pound relative to where it happened to have been many years ago is far less important than the rate of change over shorter periods. It is this rate of change that determines the impact on inflation, as well as other potential side effects, including the risk of a wider market panic.

In particular, the year-on-year decline of around 20% in the pound in 2016 drove consumer price inflation to a peak of around 3% in 2017. That, viewed in isolation, was clearly a bad thing. More recently, though, the decline in the pound has been much smaller – around 4% compared to 12 months ago – despite setting some new multi-year lows along the way. Correspondingly, the inflationary impulse will be much smaller too. There has been no panic in other markets either. This is not, yet, a crisis.

Of course, the pound could weaken further if the UK does indeed leave the EU without a deal. Nonetheless, four factors should limit the downside:

First, the decline since 2015 means that the pound is already looking cheap again. The OECD and IMF’s estimates of the ‘purchasing power parity’ rate against the dollar, and the Peterson Institute estimate of the ‘fundamental equilibrium exchange rate’, average out at around $1.40. This is 20 cents higher than the current market rate of around $1.20.

Second, leaving without a deal would no longer be such a surprise. As the Governor of the Bank of England himself said recently – ‘the perceived likelihood of No Deal has risen sharply as evidenced by betting odds and financial market asset pricing (the UK now has the highest FX implied volatility, the highest equity risk premium and lowest real yields of any advanced economy)‘. He might have added that speculators are already running hefty short positions against the pound. To a large extent, then, no deal is surely priced in.

Third, the additional contingency planning now being undertaken means that the UK and the EU should be better prepared than they were in March. Thus, even if the markets are still underestimating the probability of exiting without a deal, this should be at least partly offset by a smaller hit to the UK economy.

Finally, of course, all currency movements are relative. The euro itself is looking shaky. Indeed, Brexit timing effects may have been decisive in causing German GDP to contract in the second quarter too. Even if the short-term disruption to the UK economy is proportionately greater, the euro area will suffer as well. Investors are also starting to lose faith in the US.

Consistent with this, even those forecasters with a relatively negative view of the economic impact of ‘no deal’ do not seem to expect a collapse in the pound. I’ve heard some (anti-Brexit) academics talk of another 30-40% decline. However, the median ‘no deal’ forecast in a recent Bloomberg survey of actual market professionals was $1.10. This would be a level last seen in 1985, but still less than 10% below today’s level. Any fall against the euro would presumably be smaller.

We would also have to consider how long sterling remained weak. Forecasting currencies is a mug’s game. But even if the pound falls towards parity with the dollar on ‘no deal’, I wouldn’t be surprised to see it back above $1.30 by the end of the year as the worst fears again prove to be exaggerated. A clear Conservative victory in a snap general election would also boost the pound, given how worried some investors seem to be about the prospect of a Labour government led by Mr Corbyn.

So when might a sterling correction become a ‘sterling crisis’, similar to those that the UK has seen in the past? In my view, a ‘sterling crisis’ is when the pound itself becomes the problem, rather than a symptom of other economic pressures (and part of the solution to them). This might come about, for example, because a disorderly run on the pound prompts the Bank of England to raise interest rates to defend the currency and keep inflation down. A further 30% slump might be a game changer here, but a 10% fall would almost certainly not. Indeed, Governor Carney has already indicated that, in his view, ‘the appropriate policy path would be more likely to ease than not‘,

What’s more, a fall in the pound has benefits, as well as costs. The 1992 sterling crisis in particular was eventually turned into an opportunity by letting the pound find its own level outside the ERM. Of course, there was more slack in the economy then (so less inflation), and also much more room for interest rates to be cut. But the idea that a weaker pound is always bad is clearly wrong.

Indeed, it is not so long ago that the big auto manufacturers were arguing that we had to join the euro to get the pound down and save the UK car industry. Many reasonable people, such as the businessman John Mills, are still arguing that sterling needs to drop a lot further to rebalance the economy.

But doesn’t sterling weakness always leave us poorer, relative to the rest of the world? Other things being equal, a fall in the value of the pound does mean that the UK will have to pay more for imports, with the resulting increase in inflation translating into a fall in real incomes. At the same time, it will reduce the price that the rest of the world has to pay for UK exports.

Nonetheless, there are an awful lot of moving pieces here. In particular, the volumes of both imports and exports will adjust over time. Some demand from UK consumers and businesses will switch to goods and services that are produced at home, reducing UK imports, while foreign demand will increase, boosting UK exports. This will support UK GDP, employment and incomes.

The impact will depend on state of the economy too. If domestic demand is weak, importers will find it harder to pass on higher costs to consumers. And if there is spare capacity, it may be easier to find the resources to produce more exports. Thus, a fall in sterling is more likely to be a net positive during an economic downturn (which is presumably what is feared here).

The fall in sterling will also increase the attractiveness of the UK as a destination for investment from overseas. Some Remainers are sniffy about this, claiming a weaker pound simply allows foreigners to buy up UK assets ‘on the cheap’ (with particular disdain, it seems, for money coming from outside the EU). But these financial flows still represent an increase in the capital available to UK businesses, and are another important way in which the currency can act as a shock absorber. The fall in sterling in 2016, for example, helped stabilise the UK commercial property market in the wake of the referendum result.

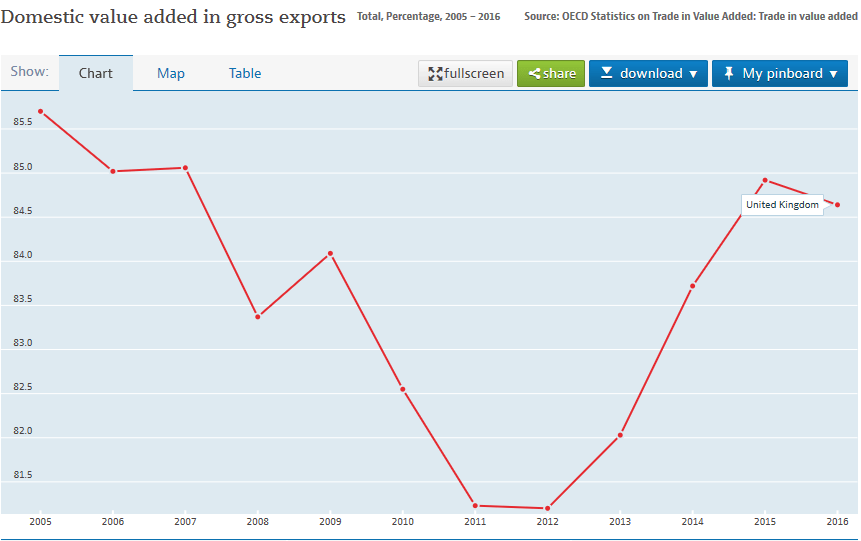

Some economists have made more sophisticated arguments. For example, it has been suggested that exports will not benefit as much from a weaker pound as they have in the past, because of the increased importance of cross-border supply chains where more content has to be imported. But this doesn’t mean that there will not be any boost. Indeed, the latest OECD data (shown in the chart below) still put the share of domestic value added in UK exports of goods and services at nearly 85%, and it has recently been rising again.

It has also been suggested that the global downturn, and trade wars, will limit the upside for exports. But even if export volumes do not rise, and UK exporters are unable to gain market share, they will still benefit from the increased value of overseas sales when translated back into sterling.

Others have argued that Brexit uncertainty may mean that firms are wary of investing more in increased capacity to take advantage of a weaker pound. But if so, this delay should only be temporary, provided the worst fears are again proved wrong.

Indeed, there is already evidence that UK businesses are feeling more optimistic about the future and that this is due, in part, to the more competitive currency. For example, the July services PMI reported that ‘a number of survey respondents commented on improved sales to clients in external markets, helped by the weak sterling exchange rate against the euro and US dollar. Moreover, the latest survey indicated the fastest increase in new work from abroad since June 2018.’

And in the July manufacturing PMI, ‘manufacturers maintained a positive outlook in July. Over 46% expect output to be higher in one year’s time, compared to less than 10% forecasting contraction. Optimism was linked to new product launches, an expected rebound in export sales, strong order pipelines, reduced uncertainty following Brexit and improved infrastructure (including 5G networks)’. (The August survey was gloomier, but 40% of UK manufacturers still expected to increase output over the coming year, compared to only 13% anticipating a decline.)

Finally, there is plenty of hard evidence that the weaker pound has supported foreign investment into the UK, not least the tech sector, and boosted tourism.

In summary, this is not a sterling crisis, nor it is likely to become one. Further falls in the pound to new lows are obviously possible, but the magnitude of the decline (and hence the impact on inflation) should be much less than in 2016. It may also only be temporary as uncertainty clears. In the meantime, any further hit to real incomes could be offset, if desired, by measures such as a temporary cut in VAT and increases in welfare payments to the most vulnerable. And let’s not forget that a more competitive currency has significant economic benefits too.

This is an extended version of ‘Sterling crisis? What crisis?’, first published by CapX