The joint team from No.10 and the Treasury working to prepare the Budget has apparently decided to junk the plan to raise the basic and higher rates of income tax.

The official line is that this is not a “U-turn” because this plan was just media speculation and never official policy. Pull the other one.

The speculation was coming from the Treasury itself, notably the “scene setter” speech from Rachel Reeves on 4 November. Ministers made no attempt to push back on the narrative that this was paving the way for a breach of the manifesto commitments.

A more charitable interpretation is that the OBR has found a few extra billion pounds behind the sofa. More favourable assumptions about inflation, wage growth, or interest rates could all help to reduce the size of the hole that has to be filled with tax increases.

However, it is hard to believe that the OBR’s forecasts have improved sufficiently at this late stage to mean that it is no longer necessary to raise tax rates.

Crucially, the OBR’s final pre-measures forecast (round 3) at the end of October would already have included any good news last month, including the fall in interest rates (up until 21 October). The reports that Reeves had submitted a plan to raise income tax appeared later (after round 4).

It is more plausible that the decision to dump the plan to raise income tax rates was based on fears about the political fallout. Frankly, I’m looking forward to hearing the OBR’s side of the story once the Budget is done and dusted. Throughout the process the OBR has acted with integrity and refused to provide a running commentary. At least someone still respects Budget ‘purdah’!

In any case, even if better news on the economic and fiscal backdrop is the real reason, why not make more of that sooner? Instead, the latest signals are that the Chancellor will try to raise more money elsewhere, including from tinkering with tax thresholds and from a dog’s breakfast of smaller measures targeting what Labour considers to be those with the “broadest shoulders”.

In particular, it still seems likely that the Chancellor will extend the current freeze on personal tax thresholds beyond 2028, which would drag even more people into paying higher rates of tax.

Extending the freeze would still breach the spirit of the manifesto commitments, even if not necessarily the letter. Rachel Reeves herself described this option as a tax on “working people” when ruling it out in her first Budget speech last year.

The Chancellor could still try to find more money by lowering the tax thresholds. She might cut the limit at which the 40% higher rate kicks in, say from £50,270 to £46,000, and still claim to be protecting “working people”. But this would hammer families on modest incomes and could be even more unpopular than a penny on the basic rate.

Ruling out an increase in the basic rate also means that many other options that have previously been rejected are now back on the table. For example, the Treasury had (it has been reported) decided against a new “exit tax” on wealthy Brits leaving the country, or raising more from National Insurance on LLP partnerships.

These decisions were taken on the grounds that these measures would not raise much money after all, so bringing them back would be another sign of desperation. Higher taxes on pensions, on gambling and on bank profits all appear to be back in play too.

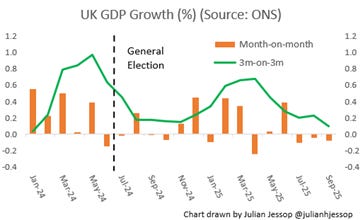

In the meantime, the obvious casualties are the Government’s credibility and confidence in the rest of the economy. Growth has already stalled as consumers and businesses put spending, hiring and investment on hold. Indeed, the latest official figures show that GDP fell (before some favourable rounding) in every month of the third quarter from July to September.

Of course, delaying the Budget until late November was always risky, but at least it gave the Government more time to work out a decent plan. With less than twelve days to go, there still does not appear to be one.

Bond markets were already starting to get nervous about new spending pledges in the Budget, including scrapping the two-child cap on benefits. The unwillingness to take tough decision on either tax or spending threatens to reverse all the fall in the cost of government borrowing over the last month – a move which owed more anyway to the latest news on inflation and unemployment.

Above all, it is hard to escape the conclusion that the Budget plans are being rewritten at the last moment in an attempt to placate Labour MPs and save the Prime Minister. Investors’ hopes that the ”grown-ups” are back in charge have been thoroughly trashed.

This is an extended version of a piece first published by the Daily Telegraph on 14 November

Hi Julian,Another excellent analysis and comment on this absolute shambles of a Government and Treasury department. One just has to wonder how much more flip flopping and uncertainty will occur in the next 13 days. No wonder the the electorate and markets get so jittery.🤷♂️ Keep up the good work.👍Best regardsJohn

Sent from the all-new AOL app for iOS

LikeLiked by 1 person

Thanks John!

LikeLike