ICYMI, here’s a summary of my comments on X (formerly Twitter) on today’s Bank of England announcement…

The Bank of England’s decision to cut interest rates by ¼% to 4½% was welcome but completely overshadowed by a gloomy set of forecasts. The MPC has been forced to act because the UK economy is crashing.

The Bank now expects GDP to stagnate in the short term and to grow by just ¾% in 2025 as a whole – half the pace predicted as recently as last November.

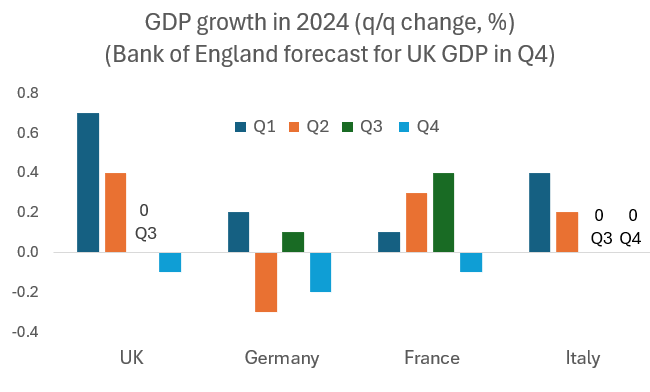

It is hard to see the new forecasts as anything other than a damning assessment of the fallout from the Budget. Other major economies in Europe have also stalled, notably Germany, France and Italy, but the turnaround has been much sharper in the UK.

Moreover, headline inflation is now expected to rise as high as 3.7% later in the year. This is mainly due to “higher global energy costs and regulated price changes” (the Ofgem cap), but “underlying domestic inflationary pressures are expected to wane further” (so it is still OK to cut rates).

I don’t expect inflation to rise that far myself, given the weakness of broad money growth and the collapse in economic activity, especially the labour market. But it is reassuring that the MPC is willing to look past the temporary impact of higher energy prices and to keep lowering rates.

The Bank will probably continue cutting gradually, but rates will remain ‘restrictive’, meaning that they will still hold back growth. It would have been better to cut by at least ½% today, as recommended by the IEA’s Shadow Monetary Policy Committee and by two members of the real MPC.

Remember also that the OBR had already factored in another 1% of cuts over the next year or so (to 3½%) in the October Budget. Rate cuts along these lines will not therefore improve the forecasts for the public finances.

In short, it is good news that rates have been cut, and they will almost certainly be cut further over the course of 2025. But the key driver is the worsening economic outlook, with growth stagnating and inflation expected to pick up sharply. Overall, then, there is very little to cheer here.

ps. here is a handy chart of all the Bank of England’s new growth forecasts:

Two more takeaways. Firstly, there is a good chance that growth is actually lower this year than last, which would be a huge political blow to the government and to Rachel Reeves in particular. But secondly, also note the upward revisions to later years – if the OBR does the same this could preserve some of the fiscal headroom, despite a weaker 2025.