It is great to be able to start with some good news…

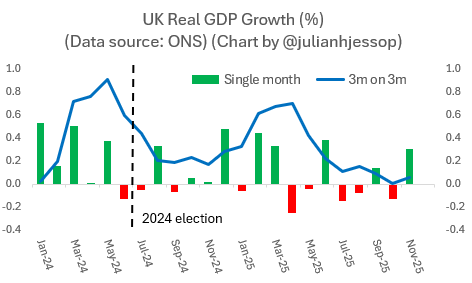

The 0.3% growth in the UK economy in November was a bit better than consensus expectations of around 0.1%, with some favourable revisions to previous data as well.

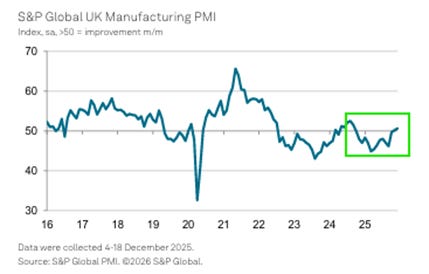

The detail showed that the bounce in November was driven in part by a rebound in car production after the Jaguar Land Rover cyber-attack in September. Encouragingly, the manufacturing PMI improved a little further in December, suggesting that the recovery in this sector still had some positive momentum at the end of last year.

Moreover, unless something really weird happened in December, the economy grew by around 0.1% in the final quarter of last year (which would be the same as the third quarter). The UK is therefore not yet in the early stages of a “recession”, at least on the usual definition of two successive quarters of negative growth.

Finally, the UK economy probably grew by 1.4% in 2025 as a whole. This would be just a rounding error below the 1.5% assumed by the OBR for the November Budget. It compares favourably as well to the first official estimate of Germany’s economic growth last year (also released today), which was just 0.2%.

Now, the caveats…

First, the monthly GDP data are volatile, meaning it is better to look at several months together. As the next chart shows, the UK economy still contracted in five of the eight months between April and November, leaving trend growth barely above zero.

To be precise, the three-month on three-month growth rate picked up only marginally from 0.01% in October to 0.05% in November (rounded by the ONS to 0.0% and 0.1% respectively).

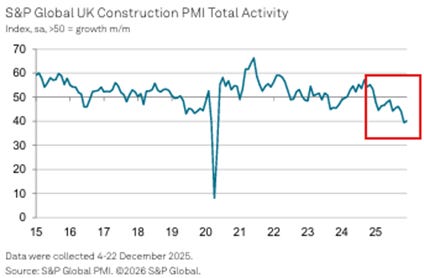

Second, November saw another large monthly fall in construction activity, adding to evidence that the government’s mission to “build, baby, build” is failing to launch. (See my earlier post on this here.)

Indeed, output in this sector is estimated to have fallen by 1.1% on the three-month on three-month comparison. The PMI for construction is also much gloomier than for manufacturing.

Third, the 0.3% pick-up in services output in November is hard to square with all the survey evidence of pre-Budget jitters.

Perhaps tellingly, the largest positive contribution here came from “professional, scientific and technical activities”. Some of this could be attributed to the resilience of what Doug McWilliams calls the “Flat White Economy” (google it!). But it also included a 4.6% jump in accounting and tax consultancy, which could just be a temporary boost due to the Budget uncertainty.

In short, both the three-month trends in the official data and the persistent softness in most surveys of consumer and business confidence suggest that the economy remains weak. Even if the UK avoids a technical recession, growth is likely to remain too slow to escape the “doom loop” of deteriorating public finances and ever higher taxes.

But today there is at least something to cheer.