A couple of weeks ago, the Chancellor was widely criticised for calling the FTSE 100’s climb past 10,000 a “vote of confidence in Britain’s economy”. As many commentators pointed out at the time (including myself), the FTSE 100 is dominated by large global companies, while the more domestically focused FTSE 250 has underperformed.

I would be happy to leave it there. However, many Labour cheerleaders are still trying to claim the latest record highs on the FTSE 100 as a “win” for Rachel Reeves.

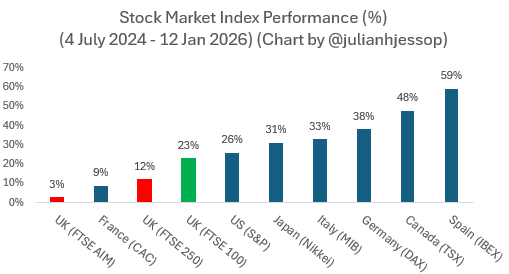

My first chart therefore puts the post-election performance of the FTSE 100 in perspective. It also includes the FTSE 250 (the mid-cap companies ranked 101st to 350th by size) and the AIM index (companies quoted on the Alternative Investment Market, which are mostly smaller and less well established).

The recent rally in the FTSE 100 owes a lot more to its large weights on banks, commodity (especially mining), and defence stocks – all sectors that are doing well globally. Despite this, the FTSE 100 has underperformed against most of its peers since the UK election in 2024, when Labour came to power.

Moreover, as this next chart shows, the FTSE 250 and AIM indices – which are much better barometers of the health of the UK economy – have lagged some way behind the FTSE 100. (You can track all the FTSE indices here.)

Crucially, about 75-80% of the revenues of FTSE 100 companies are earned overseas. This means they are less dependent on the strength of the UK economy and may even benefit from weakness if this means lower interest rates and a lower pound (which increases the value of foreign currency earnings when translated back into sterling).

In contrast, this share is less than 50% for the FTSE 250.

To be clear, the rally in the FTSE 100 is still a “good thing”. Higher equity prices boost the wealth of UK households, help to lower the cost of capital for UK companies, and generate some rare positive headlines.

Instead, my point is that this rally mainly reflects global factors rather than the policies of the incoming Labour government. If anything, the fact that the UK markets have underperformed should be a source of concern.

A similar point applies whenever Starmer and Reeves try to claim credit for the cuts in official interest rates since the election. Since June 2024 the Bank of England has cut UK interest rates six times, to 3.75%. But the US Fed has also cut six times, to a range of 3.50% to 3.75%. And the European Central Bank has cut eight times, to just 2.0%

It also looks out of touch for any party to trumpet rising asset prices as a big win when the real economy is struggling, and more jobs are being lost. Imagine going into any village pub and telling the landlord they should cheer up because the FTSE is above 10,000…

Finally, this narrative creates a hostage to fortune. If or when the FTSE 100 falls back again – for whatever reason – is Rachel Reeves now ready to take the blame? I suspect we can already guess the answer to that!

You can follow me on X (formerly Twitter) @julianhjessop and on BlueSky

I also now post regularly on Substack.