Rachel Reeves’ Scene Setter speech today was clearly designed to pave the way for big tax increases in the Budget. But there are plenty of moving parts and much could still change, even now.

The Chancellor put her excuses in early (blaming everyone else), attempted a positive spin (tough choices are “necessary” to protect the NHS and get borrowing costs down), and hinted at broad-based tax hikes (“we will all have to contribute to that effort”).

She also signalled that she wants to raise the fiscal headroom to provide a bigger cushion against future shocks. It is very hard to raise enough to do this without touching income tax.

However, nothing is yet certain. The nature and magnitude of the tax increases still depend on the size of hole that has to be filled. The OBR’s ‘post-measures’ forecasts might be less pessimistic than the ‘pre-measures’ numbers leaked so far.

The productivity downgrade is probably baked in (costing about £21bn). But this could be partly offset by other moving parts, notably the positive scoring of new supply-side measures and more favourable assumptions about borrowing costs.

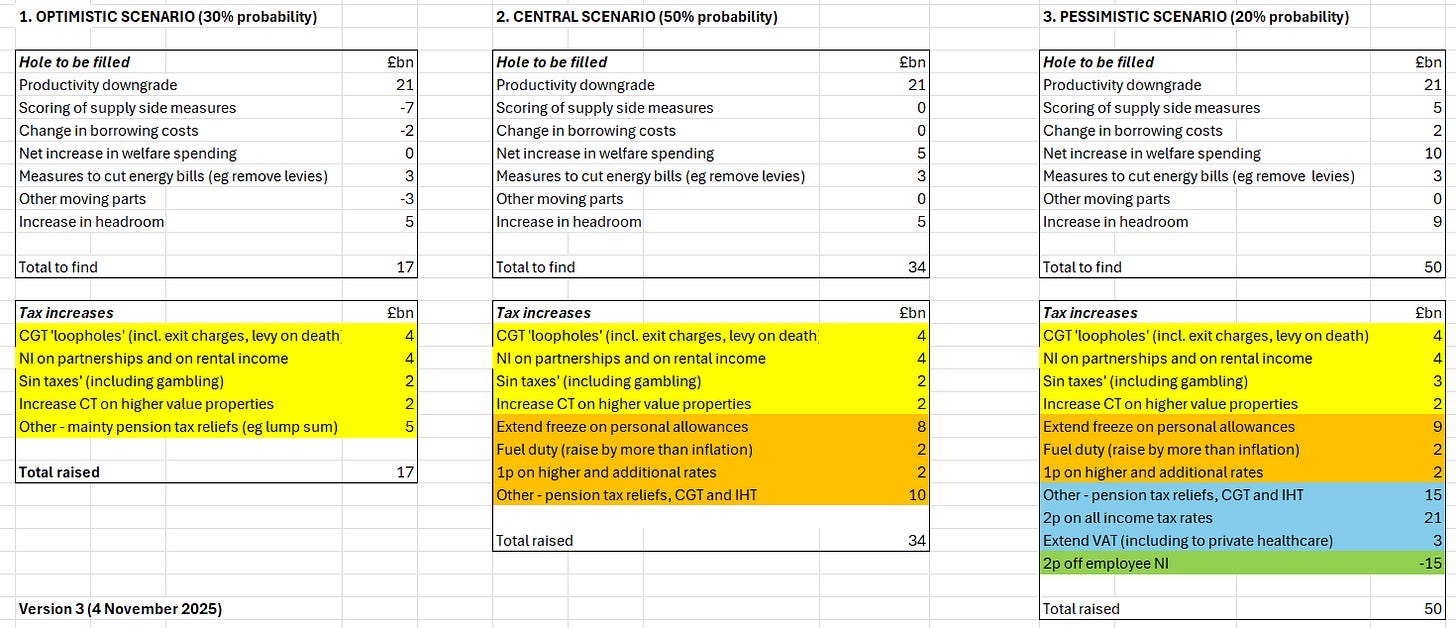

The spreadsheet below reflects this uncertainty by showing three scenarios for the size of the hole (£17bn, £34bn and £50bn) and a set of tax options for each. Obviously, these are just indicative, and there are many other options and permutations.

The ‘central’ scenario may now be ‘priced in’, and the ‘optimistic’ scenario would be a relief. Expectations have been managed to expect the worse. This points to some upside if the news is not as bad as expected.

The ‘pessimistic’ scenario creates huge tail risks – in both directions. A bumper tax-raising Budget might land OK if seen as fixing the fiscal problems “once and for all”, especially if markets like it and borrowing costs drop sharply as a result.

But it could also tip the economy over the edge, and the political fallout could prolong the uncertainty even further.

More analysis to follow!

Ps. there have been some terrible takes today on how the financial markets have reacted to Rachel Reeves’ speech. The FTSE did fall sharply at the open, but before the Chancellor said a word and in line with other European indices. UK stocks have since recovered. The pound fell only slightly and remains roughly in the middle of its range against the US dollar over the past 12 months. Most importantly, there was no significant reaction either way in the bond markets. Investors were already anticipating a tight Budget which, along with some less bad news on inflation, is why gilt yields have dropped sharply over the last month.