The Chancellor has a taxing job (pun intended), but we all deserve a break occasionally. So, I’m going to be positive about her latest Mansion House speech.

Admittedly, there is nothing here to justify the hype about a new ‘Big Bang. The so-called ‘Leeds Reforms’ (in a nod to Reeves’ constituency) are little more than a rebranding of the proposals in the Edinburgh Reforms, which were launched in 2022 under the last government.

In some cases, these plans have been accelerated (such as streamlining the clunky ‘Senior Managers and Certification Regime’). But in others they are moving more slowly (for example, we’re just going to get another review of ‘ring fencing’).

Of course, this doesn’t mean these reforms are any less worthwhile simply because Labour is doing them. In fact, financial services is one area at least where the new government does seem serious about cutting ‘red tape’.

It was certainly good to hear Reeves acknowledge that “regulation still acts as a boot on the neck of businesses”, even if she was only talking about the City.

In the event, the media’s main takeaway was the plan to encourage more people to buy equities. For instance, the BBC led with “stop being negative about savers buying shares, Reeves says”.

There is a genuine problem here. Many people who could and probably should be investing more money directly into equities face an ‘advice gap’, partly because overly cautious regulation means firms are wary of engaging with them.

Reeves proposes to address this in two ways.

First, the FCA and the industry have been working on “a brand-new type of targeted support for consumers” where advice will be specifically aimed at people for whom investment in equities might be suitable.

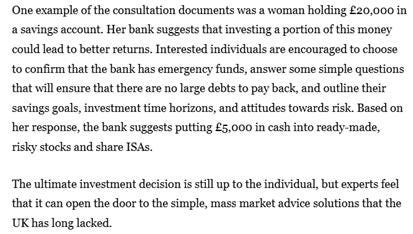

The FT’s Claer Barrett has found a good illustration of how this might work in practice.

Second, the industry will back this up with a “campaign to promote the benefits of retail investment which will launch next April”.

To the extent that this is just about providing better information and easing red tape, this a ‘pro-market’ reform that everyone should be able to get behind.

Of course there are always caveats. How independent will the advice be? Investment providers can have a vested interest in encouraging people to buy shares and in relatively expensive ways.

However, this potentially applies to almost every good or service across the whole economy. The targeted approach (and subsequent penalties) should minimise the risk of misselling.

Could some people end up losing a large amount of money quickly, given how stretched equity market valuations are at the moment?

Again, targeting particular types of customer – and with the right advice and the right products – should minimise that problem. In any event, higher returns inevitably involve higher risk.

In short, I’m with Rachel Reeves on this one!

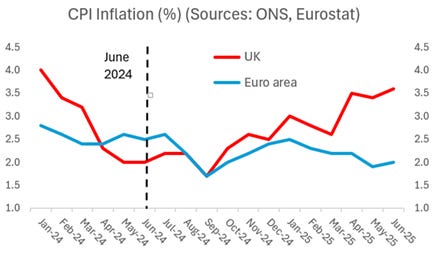

Unfortunately, any positive vibes were overshadowed today by the surprise pickup in UK inflation to 3.6% in June, from 3.4% in May and just 2.0% in the same month a year earlier. This will add to economic uncertainty and the downside risks to spending and investment.

The Bank of England is still likely to trim interest rates again next month, especially if the jobs data continue to weaken. The latest inflation figures are only just above the Bank’s own forecasts, which still see the CPI measure dropping back to the 2% target next year and staying there over the medium term (the horizon that matters most for monetary policy).

In the meantime, consumer and business expectations for inflation are stable, surveys suggest that underlying wage growth is now cooling, and growth in broad money is easing from an already slow pace.

That said, the Bank’s Monetary Policy Committee is supposed to keep inflation at 2pc at all times. Fortunately, the MPC’s mandate allows this target to be missed temporarily if the costs of correcting it quickly – in terms of lost output and jobs – would be too great.

Nonetheless, the gap between inflation in the UK and the euro area has widened markedly since last October’s Budget.

The obvious culprit is the continued pass through of higher payroll costs following the large increases in employers’ National Insurance contributions and in the national minimum wage.

It was always likely that these policy choices would backfire on ‘working people’, both by raising prices and cutting jobs. But they are clearly making the Bank of England’s task a lot harder too.

It is also no surprise that confidence among small businesses is at a record low, according to the Federation of Small Businesses. These are the firms most vulnerable to higher costs and additional red tape, and perhaps least likely to benefit from the Leeds Reforms.

So only ‘one and a half cheers’, but this is better than a loud raspberry.