This is the first time I have ever had to post twice in one day on the same topic, but here goes…

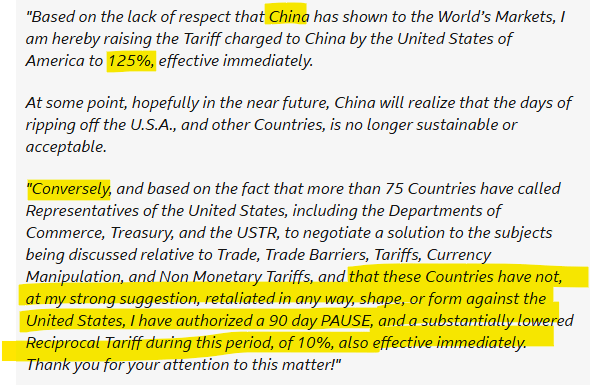

President Trump has just raised tariffs on China to 125%. However, he has also announced a 90-day pause on the ‘reciprocal tariffs’ for those countries that have not yet retaliated.

On balance this is clearly good news, and markets have initially reacted accordingly.

Trump and his supporters will spin this as proof that his tough stance is working, though others will say he has backed down in the face of the real threat that a global trade war would trigger a US recession. The overall approach is still incoherent and chaotic.

Moreover, while the immediate risks to the global economy have eased, the escalating US-China trade war will still be bad for everyone, tariffs on most US imports will still be higher than last month, and it is still uncertain what will happen after the 90-day pause. In the meantime, the new 10% baseline tariff will still apply (including to the UK).

In short, this is a temporary easing of hostilities on most fronts and total war has not yet broken out. Investors are therefore right to be relieved and, for now at least, the advice to ‘wait and see’ has been vindicated. But it is obviously still far too soon to sound the all clear.

Alice had a saner time in wonderland.

LikeLiked by 1 person