Many people are understandably still confused about the huge differences between the official figure of ‘just’ £3.4 billion for the cost of the Chagos deal, as cited by the Prime Minister, and other estimates which are as high as £30.3 billion.

Here’s my best attempt to clarify.

The top figure of £30.3 billion (which I first saw mentioned by The Daily Telegraph’s Tony Diver) is easiest to explain. This is simply the sum of all the cash payments over the initial 99-year period of the deal, assuming 2% annual inflation for those payments that are indexed.

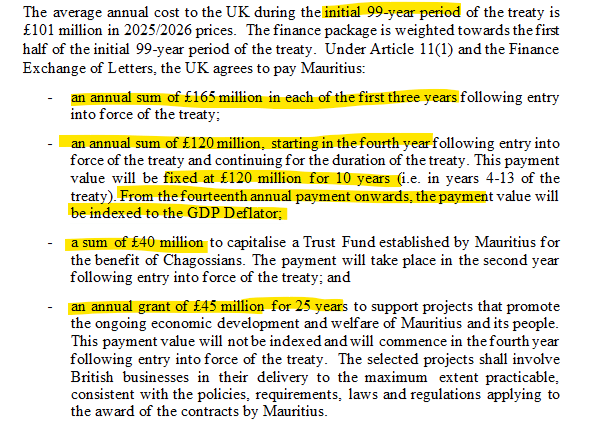

Here is how these payments are broken down in the UK government’s own explanatory memorandum…

It is rather harder to explain the average annual cost of £101 million, as also cited by the PM, but note this is in 2025/26 prices. In other words, it strips out the impact of inflation (and crucially, the indexation only applies to some of the payments in later years).

So why then is the official costing of the deal put at £3.4 billion, not about £10 billion (£101 million * 99)? This is the FT’s question that the PM struggled to answer at his press conference trying to sell the deal.

The reason is not the impact of inflation, which is already reflected in the £101 million.

Instead, it is because the figures are also discounted using the Treasury’s ‘Social Time Preference Rate’ (STPR), based on the figures below, to give a ‘net present value’. (Again, note the STPR is a ‘real’ rate, separate from inflation.)

Does this make any sense? Partly…

This approach is standard practice. Time preference simply reflects the fact that £100 in the future is not worth as much as £100 now, even in the absence of inflation (as the Green Book itself explains in detail).

The £3.4 billion figure is therefore a reasonable way to present the financial costs of the Chagos deal. In contrast, the £30.3 billion does not take account of the fact that the payments will be spread over nearly a century, and that their real value will be eroded by inflation.

In summary, the cost of the Chagos deal can be presented in two ways:

1⃣ about £30 billion in cash terms, spread over 99 years

2⃣ an NPV of £3.4 billion, i.e. the equivalent cost in real terms if we made a single payment today

In my opinion, both are correct, but 2⃣ is better.

Nonetheless, this is still not satisfactory, for four reasons.

First, the comms around this have been terrible, not least the PM’s garbled explanation. In my opinion and that of at least some others, this has further undermined confidence in official statistics.

Second, the lack of consistency is also galling. Government ministers are quite happy to cite much higher undiscounted cash figures when it suits them, especially when talking up long-term spending plans!

Third, the methodology may be correct, but the discount rates used here are arguably too high, especially when applied to known costs rather than uncertain benefits.

Fourth and perhaps most importantly, £3.4 billion is still a large amount of money, and any sum is too high for a deal that is against the interests of the UK (and the Chagossians themselves). In the words of a RUSO commentary last year, “The UK’s Surrender of Chagos is a Symptom of Strategic Ineptitude”.

In summary, the financial cost is certainly not the most egregious part of the Chagos deal, but it is significant and has been poorly explained.

This strikes me as double accounting and public sector obfuscation.

Nett Present Value is the best way to assess a project.

I can see no justification for using tenuous discounting to apparently make the reality less expensive.

LikeLike